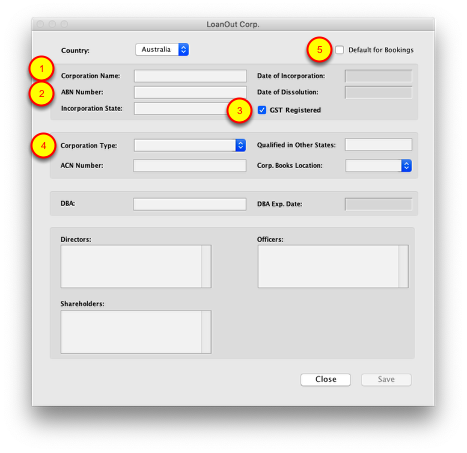

When a client is to be paid as a company and not as a PAYG then use the LoanOuts window in Addresses under the vitals tab.

Step 1

Name: Can be the name of the Client, Company or Partnership. There can be multiple corporations all with the same Name but different Corp Types but they should have different ABN numbers.

Step 2

ABN Number: enter ABN details (eg: xx xxx xxx)

Step 3

GST Registered – Mark if GST registered. A company earning more than 75k should be GST Registered. This would not be the case for Overseas company. You can verfiy that the ABN, ACN or Name is correct at https://abr.business.gov.au

Step 4

Corporation Type – Select drop down arrow for a pop up list. The Corporation Type will be appended to the name when choosing the Pay To on a booking.

*IMPORTANT: You can add whatever you like to the list but Sole Trader or ST, either are recognized by the system, should be in to the list so that when selected and the compnay is not GST Registed a heading of “Tax Invoice” will not be used.

Step 5

Default for Bookings: Check this box if you would like the PAY TO set to the Loan Out entity by default instead of PAYG. The system will automatically default to the name of the client which is PAYG.

PAYG: If a booking’s Pay To is linked to the Client’s Name or Sole Trader, then the employer will collect pay as you go (PAYG) withholding amounts from the pay check.

If the client has an Overseas company then it should not be GST registered. Use the Corp. Type pop up list to signify it as OverSeas.

Invoice Remarks shown on the invoice will be determined by the way the Pay To is listed on the booking. Remarks are set up in the Admin using the three following criteria:

Loan Out

Sole Trader

Individual or PAYG

An globally alternate heading on Invoices can be entered into Admin for all Non-Taxable invoices, such “Payment Request”.

For Bank Account Instruction see https://www.inentertainment.com/help/Direct_Deposit_Transfer_Setup.html