This FAQ will show you how to setup and process Literary Royalty Payments.

Step 1

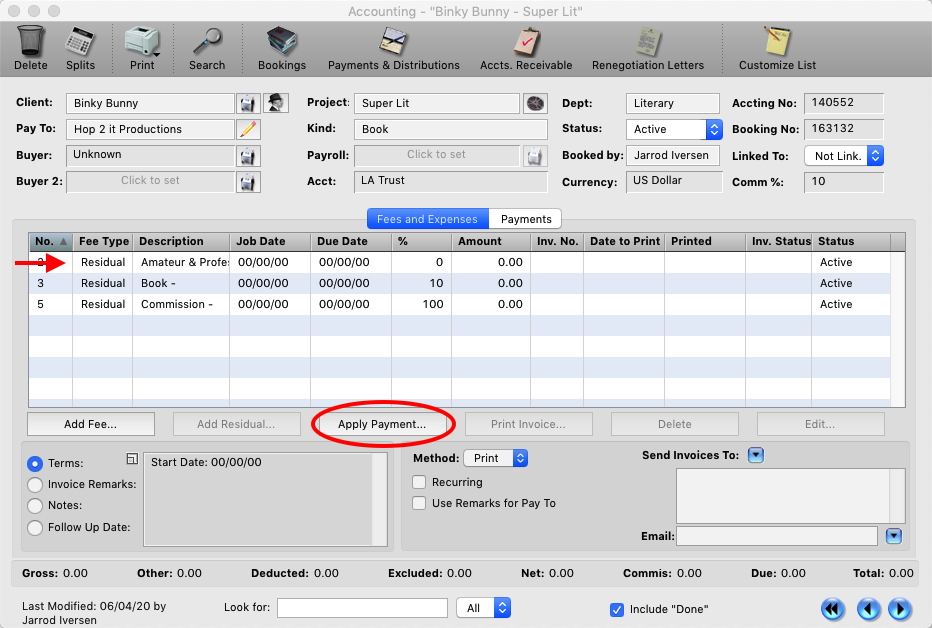

On the accounting record create the following residual lines.

A. Amateur and Professional at 0% commission rate.

B. Book at 10% commission rate.

C. Commission at 100% commission rate.

*NOTE – For 1099s, payments applied to Residual fee type lines will go into the Royalties Box on the 1099 forms.

Step 2

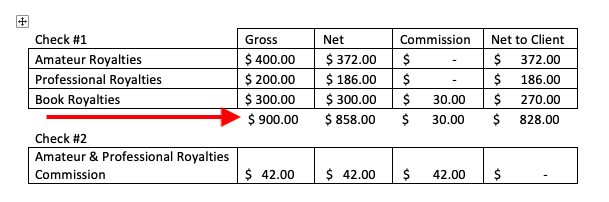

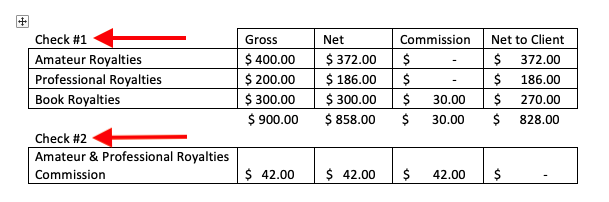

Using the following example where Check #1 the buyer/payroll has deducted your commission for Amateur and Professional Royalties and are paid in a separate check, (Check 2).

Step 3

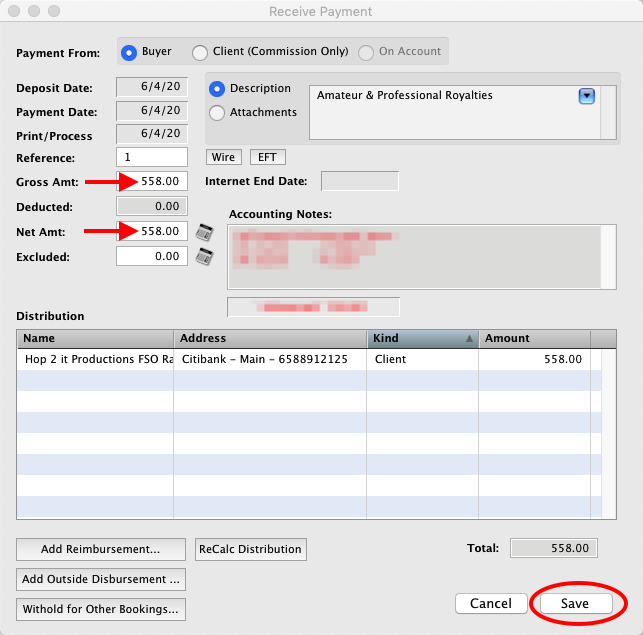

Select the Amateur & Professional residual line and click apply payment.

Step 4

Since your commission was already deducted and comes separately use the Net amount of these items as the Gross and Net amounts. In this example $372 + $186 = $558.00. Save when finished.

Step 5

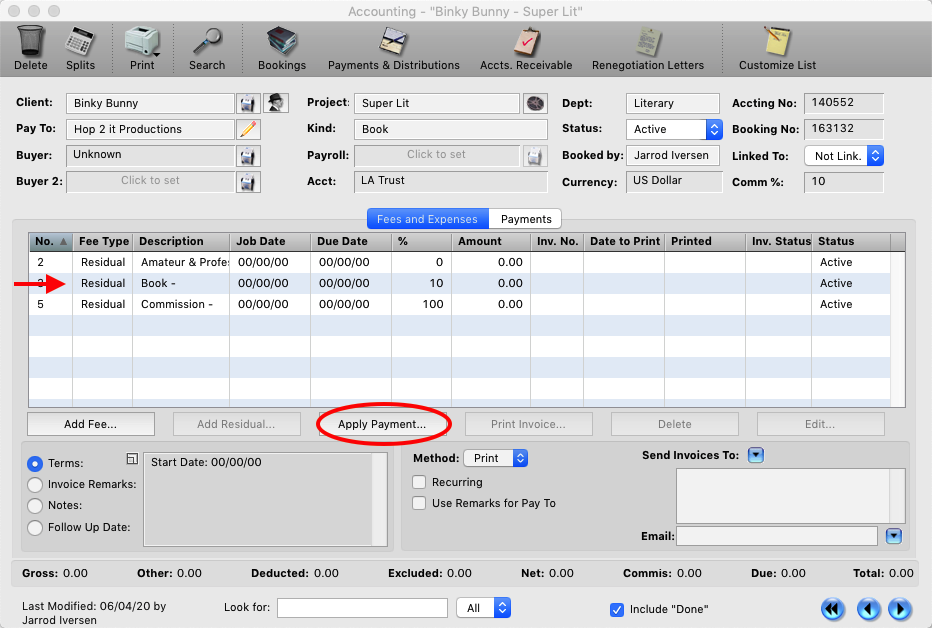

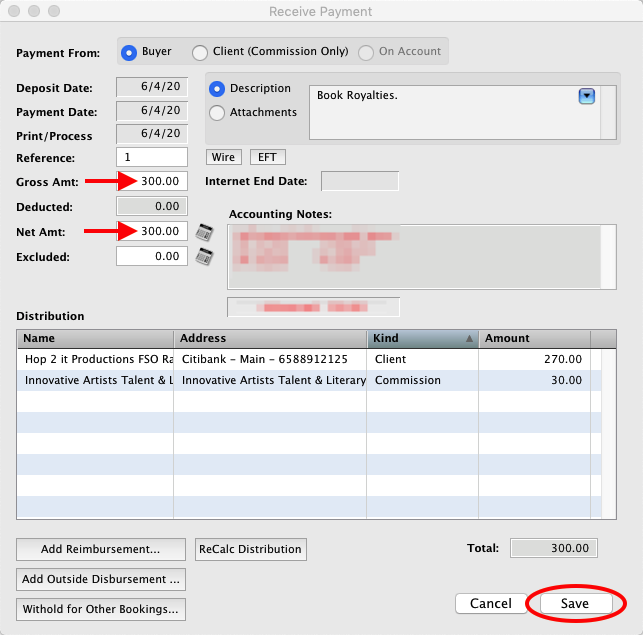

Select the Book line and click apply payment.

Step 6

For the Book royalties your commission the payment is entered as normal, the Gross is the Gross and the Net is the Net. In this example both are $300.00. Save when finished.

Step 7

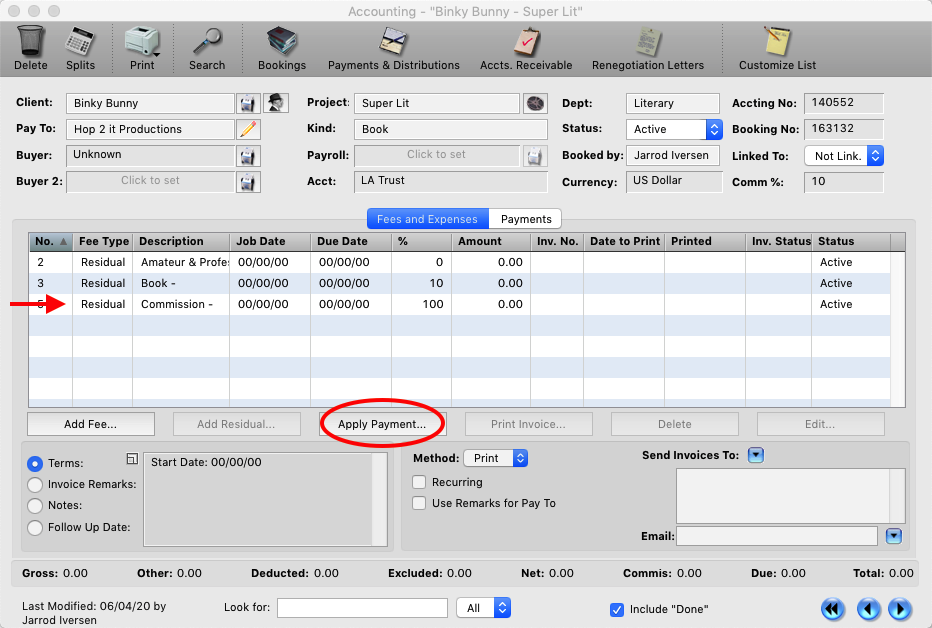

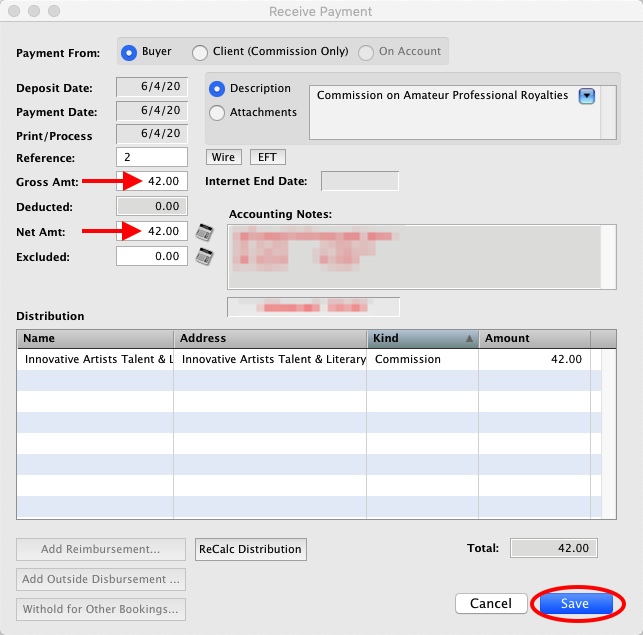

Select the Commission residual line and click apply payment.

Step 8

For the Commission payment on Amateur and Professional royalties the Gross and the Net should be the same as it’s 100% commission. Enter the Gross and Net as normal, save when finished.

Step 9

If you look at the payment breakdown compared to the running totals at the very bottom of the accounting window they match. The total Gross for the client was $900.00 with $72.00 for commission.